This article translated what I wrote in japanese into English. Although it may be unclear by the expression of English, if you read this article you can grasp the image of ADK(Aidos Kuneen)

Contents

The smaller the number of issued cryptocurrencies, the more valuable

Not only cryptocurrency, but also the number of issued currency is directly linked to the value per piece. As an extreme example, if the number of cards issued is 100 million or only 1000, the value per card is different.

Number of ADK issued

The maximum number of ADKs issued is 25 million. Because it uses a technology called DAG, it has already been issued at the beginning.

The breakdown of 25 million issued by ADK is as follows.

- Market distribution: 10.2 million sheets

- ADK Foundation: 9.8 million sheets

- Developer ownership: 5 million sheets

Currently there are only 10.2 million sheets ADK in circulation.

The following is the maximum number of issued cryptocurrencies.

- Bitcoin (BTC): 21 million sheets

- Ripple (XRP): 100 billion sheets

- Ethereum (ETH): None

- Nem (NEM / XEM): about 9 billion sheets

- Litecoin (LTC): 84 million sheets

About Burn and AirDrop

ADK does not perform “Burn” or “AirDrop”. There are no plans to do this in the future.

About “Burn”

“Burn” means to increase the price by reducing the quantity issued. For example, assume that the number of issued cards is 100 million sheets. By “Burn” 30 million sheets of those, the actual circulation number will be reduced to 70 million sheets, and the value per piece will increase.

“Burn” is done by the management side, and in practice, the cryptocurrency is put in a dedicated wallet so that no one can take it out. In other words, the cryptocurrency possessed by the current owner is not lost, but the value will increase.

About “AirDrop”

“AirDrop” means that the cryptocurrency developer distributes tokens for free.

The management side of distributing tokens for free has the following two purposes.

- Increase the number of holders and raise the degree of recognition

- Value increases with degree of recognition

There are various ways to get free distribution of “AirDrop”, such as preparing a wallet or needing SNS such as Twitter.

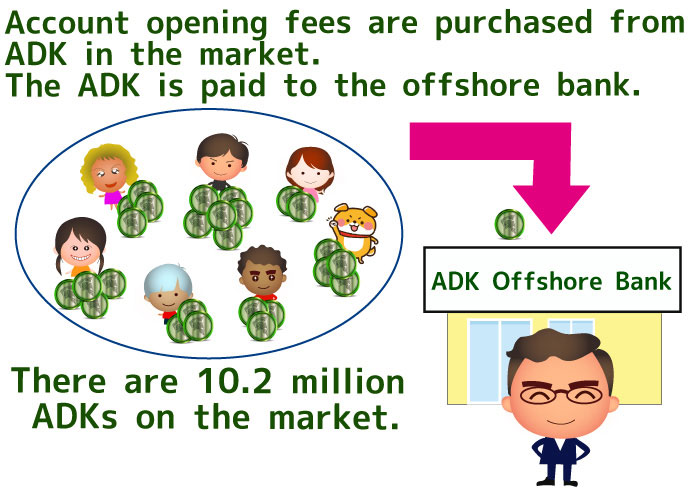

“Crypto currency ADK” for opening accounts is collected at banks

If ADK’s offshore bank is operational, online banking will allow you to open accounts from around the world. At that time, it seems that you will be asked to pay the account opening fee with ADK (excluding some such as Iran and North Korea).

According to Don’s remarks, the account opening fee is currently scheduled to be as follows.

- For personals: $ 250- $ 300

- For corporations: $ 900

- Cryptocurrency corporation: $ 2,000

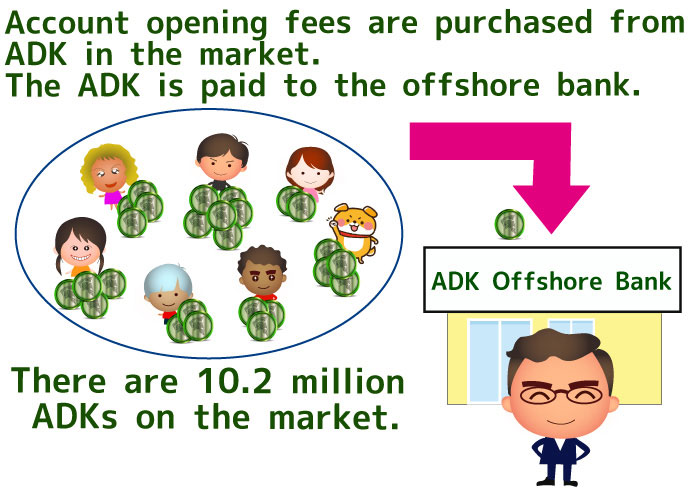

The paid account opening fee will be collected at ADK’s offshore bank. In other words, it gathers on the management side. The account opening fee will be purchased and paid from the 10.2 million sheets currently in circulation, so each time an account opening fee is collected, the number of circulation in the market will decrease.

Locked by ADK ETF

ADK is the first cryptocurrency ETF in the world! ・ ・ ・ ・ Scheduled to be

It seems that the listing is progressing in three African stock exchanges including NSE (Nairobi Stock Exchange). Regarding NSE, 10% (== 2.5 million) ADK will be locked as a security.

(* It is not clear if other stock exchanges require additional locks.)

Since 2.5 million ADK are locked by NSE, it will not be distributed to the market in the future. It means that the actual ADK that circulates is less, so here again the value per piece will be higher.

Finally

- ADK has as few as 25 million sheets issued

- ADK does not perform Burn “Burn” or “AirDrop”

- Account opening fees are purchased from the 10.2 million sheets distributed in the market and gathered for operation, so the ADK distributed in the market will decrease

- ADK ETF will be locked to 2.5 million sheets by NSE

The system is designed to reduce the number of ADKs distributed in the market, so the value of ADK is increasing.

Operation of ADK’s offshore bank (online banking). I think that it is a currency with tremendous potential if the realization of ETFs progresses firmly.