This article translated what I wrote in japanese into English. Although it may be unclear by the expression of English, if you read this article you can grasp the image of ADK(Aidos Kuneen)

Contents

Price difference between ADK spot and ADK ETF

The initial price of ADK ETF was announced to be $ 45, but the current ADK price (as of October 3, 2019) is about $ 3. In other words, the price difference between ADK spot and ADK ETF is $ 42.

The first realization of an ETF among cryptocurrencies could lead to a considerable impact and increase in creditworthiness, so the ADK spot price can be expected to rise.

However, since it is the first time, I don’t know how much impact it has. Cryptocurrency news, Kenya and other African news, and economic news from there.

the delusion is up to here … If it seems so, the price will rise rapidly, but conversely, there is a pattern that even if the price rises temporarily, it goes through without becoming news at all maybe. . .

In any case, I personally think that if ADK ETF announcement news comes out, the price will rise to $ 20 to $ 40 temporarily.

In other words, it can be expected that the price difference between the ADK ETF and the ETF will be filled to some extent between the official announcement of the ADK ETF by the NSE (Nairobi Stock Exchange) and the start of listing and trading.

In order to buy the actual ADK, you will need some knowledge and operation. Even if you purchase ADK, you must manage your wallet and SEED (secret key) yourself, and there is a risk of losing ADK if you make a mistake.

However, even if you are an analog person, you can easily purchase ETF at securities companies, and there is no need to worry about losing ADK due to your own mistakes.

So, we can expect that there are quite a few people who want to purchase ADK ETF more easily than buying ADK spot. Furthermore, since ETF have high credibility, large institutional investors who have not invested in cryptocurrency until now are highly likely to enter.

How to fill the price gap

There is a price difference between the actual ADK and the ADK ETF. The price difference can be expected to increase especially at the start of sales.

Appearance of designated participants (APs) and arbitrators (market makers) fills the gap.

What is an arbitrage trader (market maker)?

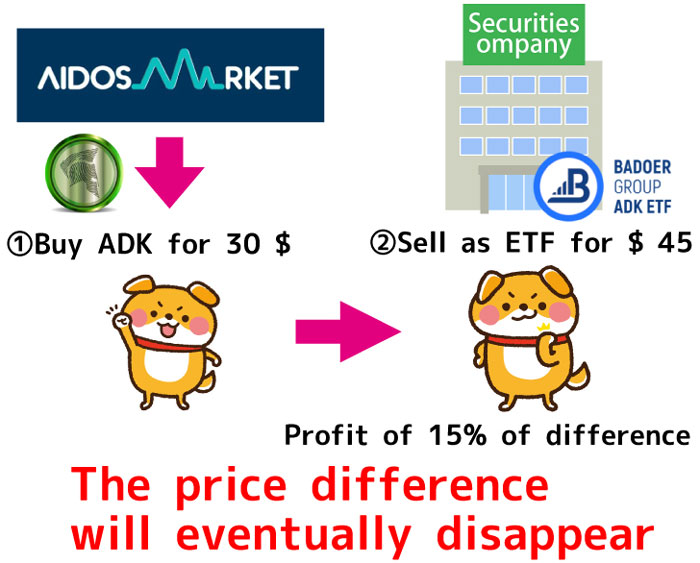

ETF market making is to make a profit by taking advantage of the difference between the ADK ETF price and the ADK ETF price on the exchange. This is called arbitrage (also called arbitrage or abitra).

The company that makes that market make is called the market maker.

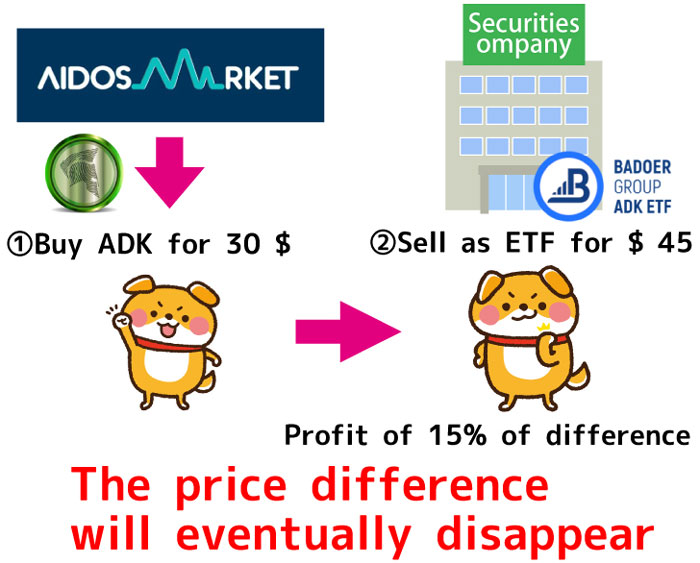

For example, let ’s say that the actual ADK was $ 30 and the ADK ETF was $ 45. That means there is a price difference of $ 15.

So, suppose you purchase for $ 30 in real ADK. Then sell for $ 45 on the ETF side. Because there is a price difference of 15 dollars, a profit of 15 dollars will be generated.

In order to gain profits, the spot ADK will be bought more and more, so the price of the spot will rise and the price difference with the ETF will disappear.

On the other hand, for example, if the cash is $ 60 and the ETF is $ 45, if you buy the ETF for $ 45 and sell it as $ 60 on the spot, you will generate a profit of $ 15.

In the future, it will be possible to convert the actual ADK into an ETF through the Bader Group.However, the exchange of ADK → ETF is not always 1: 1.

Summary

There will be a price difference between the actual ADK and the ETF, but the price difference will be filled because designated participants (AP) will arbitrate using the price difference.

Either way, the price will be determined by the impact of the world’s first ETF and expectations for future projects.